What Is Peer-to-Peer Lending – If you are not able to qualify for a traditional personal loan but need money or cash, instead of considering online lenders, banks, or credit unions, you can turn to your peers. What is peer-to-peer lending?

Peer-to-peer, also known as P2P lending is a present-day alternative to traditional bank loans. Moreover, you get connections to borrowers with a wide network of investors. To learn about this modern form of money lending, keep scrolling through this comprehensive guide to find out more.

What Is Peer-to-Peer Lending?

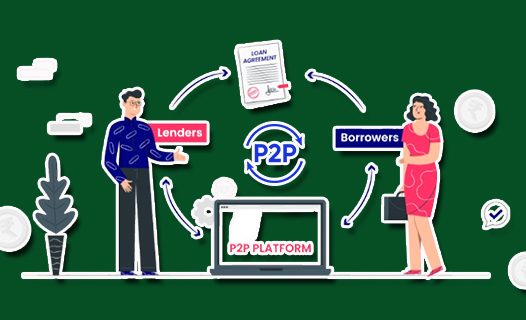

As mentioned previously, peer-to-peer lending is also known as P2P lending and it is a type of direct money lending to individuals or businesses that does not involve an official financial institution acting as an intermediary or middleman for the deal or process. Furthermore, peer-to-peer lending is usually performed through online platforms that match loan lenders with possible borrowers.

On the other hand, P2P lending provides secured and unsecured loans but most of the loans provided are mostly unsecured. In other words, the percentage of unsecured loans provided by P2P lending is higher than that of secured loans. Secured loans are quite rare in this industry and are obtained or acquired by expensive goods.

How Does It Work?

The process behind peer-to-peer lending is quite straightforward. First of all, all the transactions will be performed through a particular online platform. Secondly, a borrower who is interested in taking out a loan will begin and complete the online application process of the platform.

Thirdly, the platform will then evaluate and review the application of the borrower, determining the credit rating and risk of the borrower. An estimated interest rate will be assigned or given to the applicant.

After the loan application is approved, the borrower will get the accessible options from the investor or lender based on the interest rates and credit rating. Now, it is up to the borrower to check out the suggested options, compare, and choose anyone of them. Lastly, you will have to start paying back the principal amount and interest rate periodically.

Pros and Cons

P2P lending has become quite popular as it is one of the alternative forms of borrowing and investments. Here are some of the advantages and disadvantages:

Pros

- Diversification.

- Investment management.

- Higher returns.

- Flexible terms.

- Accessibility.

- Social impact.

- Lower fees.

- Easy to use.

- Competitive interest rates.

- Quick funding.

Cons

- Credit risk.

- Higher interest rates.

- High default risk.

- Higher fees.

- Limited regulation.

- No insurance protection.

- Tax implications.

- Unstable loan availability.

Whether you are a borrower or an investor, these are the benefits and drawbacks of going into it.

What Can I Use a P2P Loan For?

A P2P loan can be used for various possible purposes. The most common form of peer-to-peer loan is a personal loan, meanwhile, there are various available options that can also help you finance things. For instance:

- Business purposes.

- Home improvement.

- Small-business growth or start-up.

- Car purchase.

- Fertility treatment.

- Car repair.

- Debt consolidation.

- Medical bills.

- Student loan refinancing.

When You Should Consider Peer-to-Peer Lending

Here are different scenarios when considering peer-to-peer lending or P2P lending is not such a terrible idea. If you want:

- Diversity.

- Convenience.

- Short-term investments.

- Higher returns.

- More control over investments.

- Alternative income source.

- Support individuals or small businesses.

How to Start with P2P Lending

If you are interested in entering the world of peer-to-peer lending, keep in mind that the process might be a bit complicated. Nevertheless, with the right amount of guidance and knowledge, you will have no problem managing. Now, let us begin:

- Conduct thorough research on reputable platforms.

- Compare their fees, investor protection measures, interest fees, and borrower profiles.

- Understand the risk associated with going into this form of lending.

- Juxtapose the benefits and drawbacks.

- Set investment goals.

- Sign up for an account with your selected online P2P lending platform.

- Provide your personal information.

- Send your deposit funds.

- Check out the loan terms and listings.

- Choose loans carefully.

- Keep track of your investments.

- Stay updated.

Follow these steps above to effectively start borrowing via P2P lending and investing in this form of money lending.

Alternatives to Peer-to-Peer Lending

Even though peer-to-peer lending is an excellent alternative to traditional bank loans for a lot of borrowers, it is not the only option which is a good thing. Besides, before choosing any form or means of money borrowing, it is important to explore and check out available options. Here are some of the alternatives:

- Traditional bank loans.

- Lines of credit.

- Crowdfunding.

- Credit cards.

- Online lenders.

- Business loans.

- Salary advances.

- Home equity loans.

- Friends and families.

- Online installment loans.

- Microfinance institutions.

- Non-profit or government loans.

It is essential to check out the considerations and advantages of each of these alternatives before choosing. In addition, if you borrow money from your family or friends, make sure you pay it back on time as this destroys relationships.