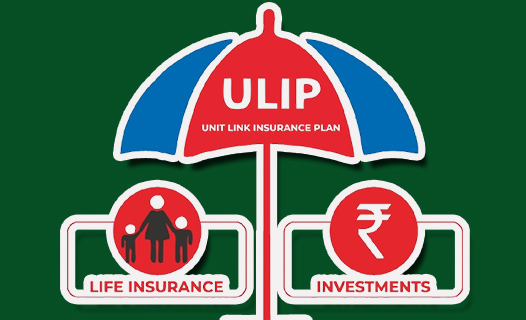

In the vast world of financial planning, a unit-linked insurance plan, also known as ULIP has surfaced as a flexible instrument that mixes the dual benefits of both investment and insurance.

Furthermore, unit-linked insurance plans offer policyholders the chance to invest in different financial products while getting coverage from life insurance, unlike traditional insurance products that only cover small investment components.

So, why worry when you have this financial product to help you grow while you stay protected? To learn more about what this insurance plan is all about, keep reading this comprehensive guide.

What is a Unit Linked Insurance Plan?

A unit linked insurance plan is also known as ULIP. Furthermore, it is a financial product that combines the features of investment opportunities with life insurance. In other words, with this insurance plan, dual benefits are offered to meet your long-term financial goals and investments. Thus, as a policyholder, you have the potential to create wealth and offer financial protection for your loved ones. This hybrid insurance product is created to meet the insurance coverage and investment growth of policyholders or individuals through one policy.

How Does It Work?

As mentioned, ULIPs are financial products that join life insurance with investment opportunities by using premiums to invest in market-linked funds and cover insurance costs. So, one part of the premium paid goes to contributing to your life coverage, and the other is invested in the fund of your preference. Therefore, you get both potential growth and protection. As for the investment in funds, you can use it to buy units in different funds.

Benefits and Drawbacks

Here are the pros and cons of unit linked insurance plans:

Benefits:

- Long-term savings.

- Investment flexibility.

- Potential for wealth creation.

- Combination of investments and insurance.

- Tax benefits.

- Partial withdrawal.

- Transparency.

- Death benefits.

- Fund switching options.

- Additional riders are offered.

Drawbacks:

- Market risks.

- High charges.

- Limited liquidity.

- Complexity.

- High cost of insurance.

- Unguaranteed returns.

- Surrender penalties.

- High initial charges.

- Complicated fee structures.

- Fund choice restrictions.

Who Should Buy a ULIP Plan?

A unit linked insurance plan is no doubt a flexible financial product that combines investment opportunities with insurance. However, this plan is not suitable for everyone. Here are the types of people who should consider getting unit linked insurance plans based on their investment preferences, financial needs, and goals:

- Individuals looking for both insurance and investment.

- Investors searching for tax benefits.

- Long-term investors.

- Individuals who want professional fund management.

- People looking for investment flexibility.

- Individuals who are interested in creating wealth with insurance protection.

- People who can manage investment risks.

- Individuals who can complete regular premium payments.

- People looking for partial withdrawal options.

- Individuals interested in well-structured financial planning.

Things to Keep in Mind Before Investing in a ULIP

It is an important financial decision if you choose to invest in unit unit-linked insurance plan as it needs careful consideration. Here are the key things to keep in mind before choosing to invest in a ULIP:

- First understand your financial goals.

- Examine the fee structure.

- Review your risk tolerance.

- Understand the lock-in period.

- Evaluate the available funds.

- Consider your premium payment capability.

- Check the terms and conditions of the policy.

- Search for additional benefits and riders.

- Check the insurance company’s track record.

- Review the death benefits and maturity.

How to Invest in Unit Linked Insurance Plan

Careful consideration and research are required before investing in a unit linked insurance plan (ULIP). Moreover, the process involves several steps that you need to follow one by one to ensure everything goes smoothly. Here is a guide you can use to successfully invest in a ULIP plan:

- Evaluate your financial needs and goals.

- Compare and research ULIP plans.

- Choose a unit linked insurance plan.

- Apply.

- Provide your personal details.

- Choose your ULIP plan feature.

- Submit the necessary information.

- Pay the premium.

- Go through the policy documents.

- Keep track of your investments periodically.

- Contact customer support if there is an issue or question you need to ask.

- Use fund-switching options.

- Make partial withdrawals if you are qualified.

- Understand everything about the surrender process.

This is because if you surrender a unit linked insurance plan before the end of its term, it might affect your returns and there might be penalties. Carefully follow these steps to begin and finish the investment process with ease.

How To Choose the Best ULIP

As you know, unit linked insurance plans are a mix of investment tools and life insurance. Hence, before choosing a ULIP, it is crucial that you remember these key things:

- Check the tax benefits.

- Review your financial goals.

- Understand the charges.

- Assess your risk tolerance.

- Search for additional benefits and riders.

- Evaluate policy terms and conditions.

- Check the fee structure.

- Compare fund options.

- Compare surrender terms and conditions.

- Shop for customized options.

- Consider fund-switchingflexibility.

- Understand the major features.

When you know and carry out the following carefully, you will have no trouble selecting the right ULI plan that works best for you.

ULIP Linked Charges

Here are the unit linked insurance plan (ULIP) charges that you need to be aware of before investing:

- Mortality charges.

- Policy administration charges.

- Surrender charges.

- Partial withdrawal charges.

- Fund management charges.

- Premium allocation charges.

Moreover, these charges are imposed by the insurance company or provider to the policyholder for different reasons.